Guide to use of home as office

It is likely your permanent workplace will be your home and as such you can make a claim for using your home as your office.

It may be that you complete fee earning work from home or simply just take care of company administration and bookkeeping. Either way you should charge your company for the use of your home.

The standard fixed rate

HMRC have a fixed rate of £4 per week to cover the general costs associated with working from home. This does not require any receipts or justification.

It is possible to claim an increased amount but you would need to provide justification to HMRC were they to look into your company affairs.

Working out how much you can claim

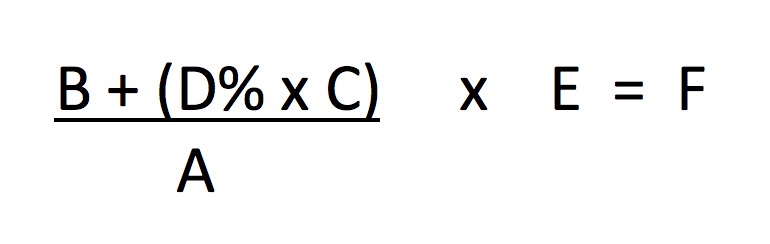

The below formula is a good starting point for calculating an increased claim based on the costs associated with running your home:

Where:

A = The total number of rooms in the home

B = The number of rooms dedicated solely for business use

C = The number of rooms used partly for business and partly for personal use

D = The percentage of time spent for business use in comparison to personal use

E = The total home expenditure including rent, mortgage interest, water and sewerage, heat and light and buildings insurance

Not sure?

Remember if you are using a substantial part of your home for business use there may be tax implications. Speak to us on 01962 790237 or contact enquiries@taxevo.co.uk to help understand this further.