Guide to pensions and automatic enrolment

To comply with the Pensions Act 2008, employers must operate a workplace pensions scheme and contribute towards it. This is known as automatic enrolment. If you employ at least one person, you have certain legal duties.

Does automatic enrolment apply to me?

Your legal duties for automatic enrolment begin on the day your first employee starts work.

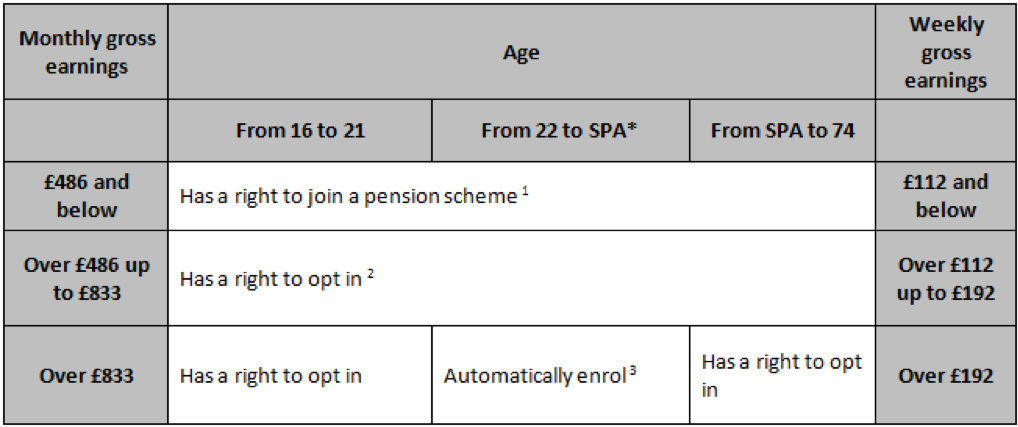

1 Has a right to join a pension scheme

If they ask you to, you must provide a pension scheme for them, but you don’t have to pay contributions.

2 Has a right to opt in

If they ask to be put into a pension scheme, you must put them in your automatic enrolment pension scheme and pay regular contributions.

3 Automatically enrol

You must put these members of staff in your automatic enrolment pension scheme and pay regular contributions. You don’t need to ask their permission. If they give notice, or you give them notice, to leave employment before you have completed this process, you have a choice whether to automatically enrol them or not.

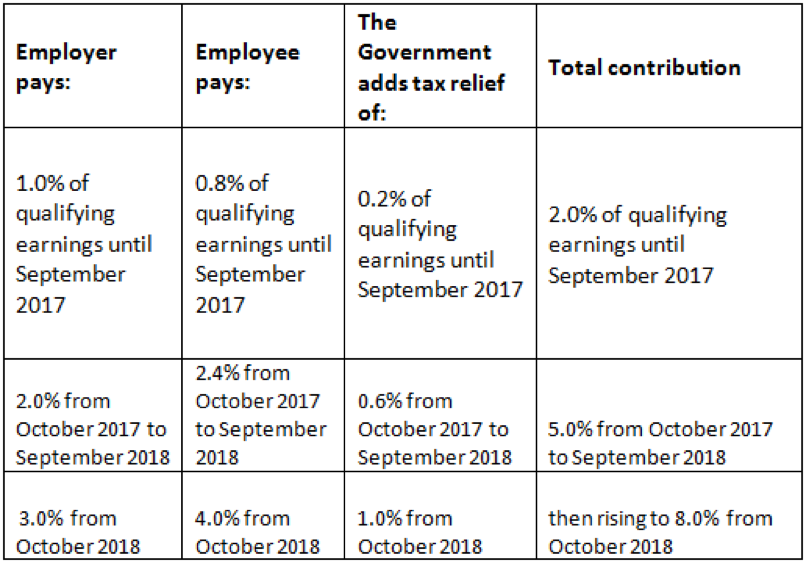

What contributions need to be made?

The minimum total contribution to the scheme is usually based on qualifying earnings. These are gross earnings from employment that fall between the lower and upper earnings limit.

Opting out

There are circumstances when automatic enrolment duties don’t apply:

- If you’re a sole director company, with no other staff

- If your company has a number of directors, none of whom has an employment contract

- If your company has a number of directors, only one of whom has an employment contract

- If your company has ceased trading

- If your company has gone into liquidation

- If your company has been dissolved

We are here to help

Not sure what to do next? We are happy to discuss automatic enrolment and your personal circumstances in detail. Just call us on 01962 790237 or get in touch on our contact form.